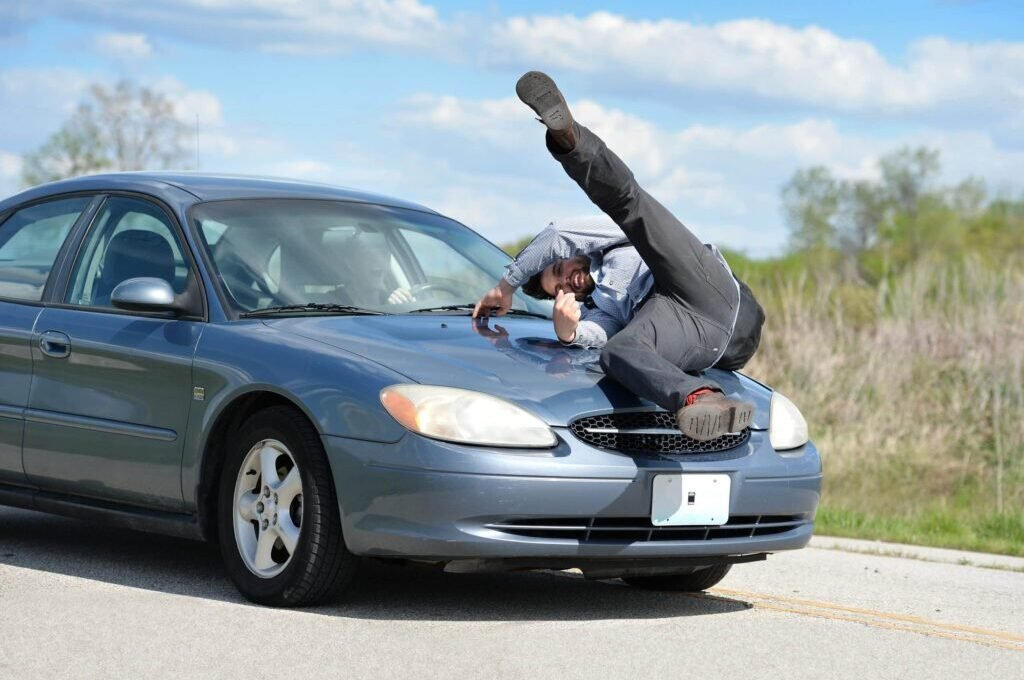

Being injured in an accident is hard enough; being left behind by the person responsible adds another layer of unfairness. Suddenly, questions about paying rent or handling weeks of discomfort become just as urgent as healing.

That’s the hidden weight of a hit-and-run: the struggles that continue long after the road clears. Hit-and-run comes under the types of car accidents, which are very complex to resolve.

Here, we’ll break down how lost wages and pain and suffering are handled and the practical ways victims can seek fair compensation.

How Are Lost Wages Handled After a Hit-and-Run?

One of the toughest realities after a hit-and-run is the sudden loss of income. Injuries can keep you from showing up at work for days, weeks, or even longer. While the at-fault driver has disappeared, the law and insurance systems still give victims ways to recover that missing paycheck. Let’s break down the four most common routes.

Here’s the breakdown of how lost wages are handled:

- Uninsured Motorist Coverage (UM): This is the most common lifeline. It covers you when the other driver doesn’t stick around, replacing lost income on top of your medical expenses. If you’ve got this coverage, it’s often the fastest way to claim what you’ve lost.

- Personal Injury Protection (PIP): Some states require PIP, which steps in to cover immediate expenses like medical bills and a percentage of your lost income. It’s often called “no-fault” coverage because you can access it regardless of who caused the crash.

- Workers’ Compensation: In case the hit-and-run occurred during some work-related job, e.g., driving a delivery route or going to a client meeting, then you can claim workers’ compensation. This kind of claim is not provided by your auto policy but rather by your employer’s insurance. Workers’ comp may pay a part of your salary, medical expenses, and even rehabilitation expenses as required.

- Filing a Claim Against the Driver: Sometimes, police track down the hit-and-run driver. If that happens, you may be able to sue for not just wages but also long-term impacts like therapy costs or reduced earning capacity.

Each option has its own process and limitations, but they share one goal: making sure your finances don’t collapse while you recover.

How Is Pain and Suffering Calculated After a Hit-and-Run?

Unlike medical bills or missed pay, there’s no simple way to tally up the nights of lost sleep, the anxiety before getting into a car again, or the frustration of missing out on normal routines. That’s why courts and insurers use specific formulas to give structure to these deeply personal losses.

- Multiplier Method: Here, the amount of your financial damages (like doctor visits, medication, or therapy bills) is used as a base number. That total is then multiplied by a figure, often between 1.5 and 5, depending on the seriousness of your injuries. The worse the injury and its impact on your future, the higher the multiplier.

- Per Diem Method: This method looks at your suffering in terms of days. A daily dollar value is set, which is often based on your income or another fair benchmark, and then multiplied by the total days you’re expected to deal with pain or recovery challenges. It creates a way to acknowledge the ongoing weight of recovery, not just the initial injury.

Key Takeaways

- Hit-and-run accidents can leave victims dealing not only with injuries but also unexpected financial losses and missed work.

- Lost wages can often be recovered through uninsured motorist coverage, personal injury protection (PIP), or workers’ compensation, depending on your situation.

- Pain and suffering are calculated using the multiplier and per diem methods, which quantify both the severity and duration of your injuries.