Key Takeaways

- Effective cash flow management is essential for the sustainability and growth of any business.

- A line of credit offers businesses the flexibility to manage day-to-day expenses and invest in opportunities as they arise.

- Strategic planning, careful monitoring, and responsible repayment are crucial when utilizing a line of credit.

- Integrating multiple financial tools can further optimize business cash flow.

Understanding Cash Flow Management

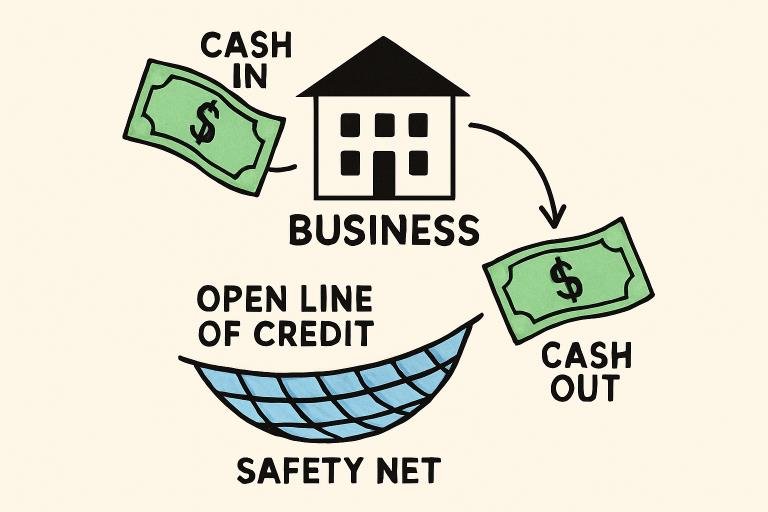

Effective cash flow management sits at the core of every business’s financial health. It requires businesses to track, analyze, and optimize cash flows in and out of the organization, ensuring obligations are met and opportunities are not missed. A sound approach helps avoid liquidity crises, streamline operations, and support long-term goals.

One of the most accessible financial tools available to small and mid-sized businesses is a ScotPac Line of Credit. With quick access to funds when needed, this versatile financial tool can address short-term cash shortfalls or support new business initiatives, providing companies with much-needed financial flexibility. Managing cash flow effectively goes beyond simply balancing accounts. It allows businesses to remain nimble and competitive even amid seasonal fluctuations or unforeseen costs. Taking a proactive approach to cash flow reduces the risk of missed payroll, late supplier payments, and stalled growth. Instruments like a line of credit offer revolving, on-demand funding. They enable businesses to meet operational requirements, bridge timing gaps, and avoid expensive penalties, making them crucial for sustaining financial stability and adaptability.

Benefits of Utilizing a Line of Credit

- Bridging Cash Flow Gaps: In many industries, revenues don’t always align neatly with expenses. Having a business line of credit ensures bills are paid on time—even when receivables lag.

- Seizing Growth Opportunities: Immediate access to funds can be the difference between capitalizing on a profitable investment and missing out due to liquidity constraints.

- Building Creditworthiness: Responsible use of a credit line, with timely repayments, can build a robust business credit profile, supporting access to larger or more favorable loans in the future.

Strategic Use of a Line of Credit

To ensure a line of credit delivers maximum value, a strategic approach is necessary. Start with clear objectives: Is the goal to handle seasonality, cover payroll, or fund short-lived projects? Knowing the purpose helps avoid misuse and supports accurate forecasting.

- Define Clear Objectives: Specific goals prevent overuse and support transparent decision-making.

- Monitor Utilization: Frequent review of your credit usage helps avoid overextending and ensures alignment with operational needs.

- Plan Repayments: Align repayment schedules with your business’s revenue cycle to maintain a healthy financial position.

Potential Risks and Mitigation Strategies

- Overextension: Even flexible credit can become a liability if overused. Regularly review balance sheets and financial statements to maintain discipline.

- Interest Costs: While only borrowing what’s needed can save money, allowing balances to linger can result in significant interest charges over time. Prompt repayment is key.

- Credit Score Impact: Late payments or high utilization can negatively affect credit ratings. Consistency protects your company’s reputation and future borrowing power.

Integrating a Line of Credit with Other Financial Tools

Modern businesses benefit from layering various financial tools. By combining cash flow forecasting software with a line of credit, organizations can gain full visibility on current and projected liquidity. This comprehensive control enables leaders to make smarter investment and operational decisions, reducing risk and improving resilience. Furthermore, integrating payment platforms, invoicing apps, and data-driven underwriting can help tailor credit solutions to your unique business cycle, streamlining approvals and ensuring timely access to capital.

Conclusion

Businesses of all sizes benefit from strong cash flow management and strategic use of credit tools. A line of credit delivers flexibility, increased purchasing power, and enhanced resilience against the unexpected. By setting clear objectives, monitoring usage, and integrating this resource with advanced financial tools, companies can achieve a healthy balance between stability and growth. Consistently applying these best practices enables organizations to weather financial storms, seize emerging opportunities, and lay a lasting foundation for success.